Chase is one of the more competitive credit card issuers when it comes to credit card balance transfer offers.

The bank offers a number of 0% balance transfer credit cards, with 0% APR for as long as 18 months in some cases, so they’re certainly one issuer you shouldn’t ignore if you’re in need of a balance transfer.

Chase Credit Card Balance Transfer Offers:

Chase Ink Cash Business Credit Card – 0% introductory APR for 12 months on balance transfers and purchases, 5% balance transfer fee (ouch!) with a minimum of $5, no annual fee.

Chase Slate – 0% APR for 15 months on balance transfers (and purchases), NO balance transfer fee! This is the only major player to offer a truly free balance transfer so be sure not to miss out!

Chase Freedom Card – $150 Bonus Cash Back and 0% APR for 15 months on both purchases and balance transfers with a 3% balance transfer fee ($5 minimum fee), no annual fee.

Chase Freedom Unlimited – 0% APR for 15 months on both purchases and balance transfers with a 3% balance transfer fee ($5 min) and no annual fee.

Southwest Airlines Rapid Rewards Premier Card from Chase – you can earn one point for each $1 of balance transfers you move to the card during the first 90 days from your account opening date (up to 15,000 points), but the APR is a sky-high 16.24%. Also a 5% balance transfer fee ($5 min) and $99 annual fee. Not recommended for balance transfers.

Southwest Airlines Rapid Rewards Plus Card from Chase – you can earn one point for each $1 of balance transfers you move to the card during the first 90 days from your account opening date (up to 10,000 points), same sky-high APR of 16.24%, 5% balance transfer fee ($5 min), and $69 annual fee. Not recommended for balance transfers.

Some Chase Balance Transfers Have a 5% Fee

During the credit crunch Chase removed the balance transfer fee cap, and charged as much as 5% in balance transfer fees, making it a relatively expensive option for cardholders in some cases. But the fee is now back to 3% or ZERO if you go with Slate.

To my knowledge, the company had never offered a no fee balance transfer before Slate, though you may have been able to get the balance transfer fee waived thanks to their stellar customer service.

If you have debt from another card issuer, such as American Express, Bank of America, Capital One, Citi, Discover, or HSBC, Slate is a great way to pay it down with no fees of any kind.

The good news is that their balance transfer offers also come with no annual fee and you can earn cash back rewards once your card is paid off. The Freedom card is one you’ll actually want to keep once the debt is gone.

If you are a current Chase credit card member, you can also log-in to your account and look at balance transfer offers for existing customers. Sometimes those offers are better than the ones available to the public, so definitely take a look if you’re already a customer.

They typically list any offers available to you, though there may not be any at any given time depending on whether you’re targeted or not.

Chase Balance Transfer Offers for Existing Customers

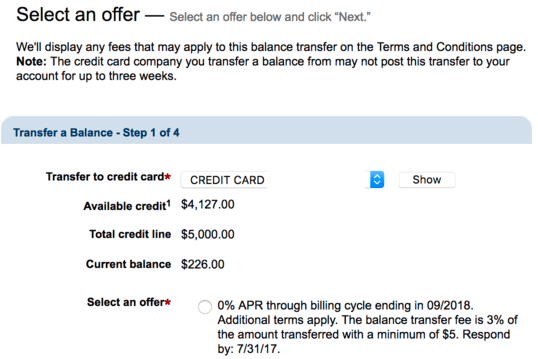

If you’re an existing Chase customer and want to see available balance transfer offers, it’s easy to do.

Once at the Chase website, click on Customer Center then scroll down to the credit card section and click on “transfer balances.”

From there, you can select one of your credit cards if you have multiple cards with Chase and you’ll see what’s currently available.

I had a decent 0% APR offer for about 14 months with a 3% fee on my Chase Freedom card.

This is one way to get a balance transfer without having to apply for a new credit card, which can help you avoid a new account on your credit report.

That’s important if you’re trying to stay under 5/24, the Chase rule that doesn’t allow approvals if you’ve opened 5 or more credit cards in the past 24 months.

Chase Balance Transfer Tips

Chase tends to charge the industry-standard 3% balance transfer fee on all their offers, which is not good or bad, just expected. However, Chase Slate is a freebie in this department, at least during the first 60 days.

Pro tip: Beware of the Chase balance transfer fee rising to 5% if you don’t execute a transfer within the first two months (6o days)…it’s a total gotcha.

Aside from straight-up balance transfers, Chase also offers balance transfer checks, which allow you to execute a balance transfer into your checking account, effectively turning the transfer into cash without a cash advance fee.

These can be handy if you need to pay other bills aside from credit cards, or if you simply need cash and don’t want to pay exorbitant fees.

These offers will be mailed to you if you’re an existing customer, just be sure to double-check the terms to ensure it’s a good deal. Generally, the 3% balance transfer fee should apply.

What’s convenient is you can make these checks out to yourself and get cash quickly if you need it.

Chase is also one of the only credit card companies to offer a balance transfer on a business card, which I know some people are looking for. The catch is that business cards can lose the promo APR if you miss a payment or go over limit, so there are less protections for cardholders versus consumer cards.

Important: The Chase balance transfer limit is $15,000 for all customers in any 30-day period, including fees and interest charges. So you can’t get anything more than that.

If you make multiple balance transfer requests during one application, Chase will process them in the order they are inputted. In other words, if your credit limit is only large enough to cover the first one or two requests, the third may be denied or only partially paid.

Lastly, know that it can take up to 3 weeks for Chase to set up your new account and process any balance transfer payments, so continue paying your old card issuers as agreed to avoid any late fees.

However, most transfers tend to be processed within a week, so you can use that timeline as a rule of thumb.

Finally, Chase may decline your balance transfer request for any of the following reasons:

[badlist]

- Your account is past due

- You’re over your limit

- You request more than the maximum disclosed

- Or simply if Chase believes you’re unable or unwilling to pay back the balance

[/badlist]