When searching for credit card balance transfer offers online, one of your main considerations should be the “balance transfer APR,” otherwise known as the “balance transfer rate.”

In short, it’s the interest rate you’ll pay on your shiny new balance transfer credit card.

And really, it’s the reason why you would want to transfer your credit card debt – to obtain a lower interest rate.

The Balance Transfer APR Dictates What You’ll Pay In Interest

- APR is generally #1 when it comes to comparing balance transfer offers

- It dictates what you’ll pay in interest each month during the promo period

- You want a card that lowers your APR considerably

- But also consider any fees attached to the offers to determine the best deal

So why is it important? Well, a high interest rate (APR) tied to your existing credit card(s) is probably why you’re looking into balance transfers to begin with.

So if the balance transfer doesn’t lower your APR significantly, there’s really no point in going through with it, especially if there are fees involved.

Quick refresher: A credit card balance transfer allows you to move credit card debt from one credit card to another to save money on finance charges (interest), which are born out of high APR.

Most credit cards tend to have APR in the high teens to 20%+ range. This is far from ideal and a huge waste of money if you carry a balance every month.

If you’re not sure what APR stands for, it’s annual percentage rate, which is the rate of interest you must pay for carrying a credit card balance, calculated annually.

Finance charges are only charged if you don’t pay off your balance in full by your credit card grace period. So if you’re “carrying a balance” beyond that date, you’re paying interest to do so.

There’s really no reason to pay interest to credit card companies with all the interest-free credit cards out there.

If this all sounds confusing, don’t be discouraged. It’s actually very easy to execute a balance transfer.

Let’s look at a balance transfer APR example:

Existing credit card balance: $5,000

Current credit card APR: 19.99%

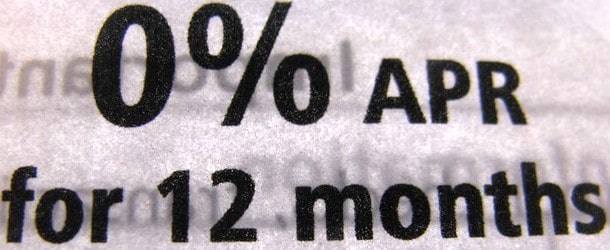

Balance transfer offer: 0% APR for 12 months, 9.99% APR thereafter

Balance transfer fee: 5%

In this example, you’d be paying roughly $1,000 in finance charges annually on your $5,000 credit card debt, or about $83 monthly (using simple math). The APR of 19.99% means you pay roughly 20% of your balance each year.

That’s not good, especially when there are 0% APR balance transfer offers out there for the taking.

Assuming you accept such an offer, your balance would immediately climb to $5,250, thanks to the associated balance transfer fee, but you wouldn’t pay any interest for a full 12 months because of the 0% balance transfer APR.

The savings using the credit card balance transfer are pretty significant because you’d be going from paying nearly 20% APR to a much more favorable 0% APR. It doesn’t take a genius to know that zero is much better than 20.

Of course, if you don’t pay off the debt in full in 12 months, you’ll be subject to finance charges again once that 9.99% APR kicks in.

It’ll still be cheaper than your previous APR, but it’s not as favorable as a 0% interest rate, which accrues zero interest. So your goal should always be to pay down your full balance before the balance transfer ends.

Balance Transfer APR Is Usually Promotional

- Most balance transfer cards come with promotional APR

- That only lasts for a short period of time, such as 12 to 15 months

- After that period ends a higher APR will kick in

- This is usually the standard purchase APR, which will likely be in the teens or even higher

Keep in mind that most balance transfer APR is promotional, meaning it only lasts for a set period of time, whether it’s six months or 15 months.

You should know how long it lasts so you can make a plan to tackle the debt before it comes to an end.

For instance, if you wanted to pay off all your debt during the zero interest (0% APR) period, you’d have to make payments of about $438 a month in our preceding example.

Paying $438 for 12 consecutive months would cover the outstanding balance of $5,250, which includes the balance transfer fee.

If you don’t think you’ll be able to pay off your balance within the promotional APR period, be sure to consider a balance transfer for the life of the balance, which will lock in a low fixed APR for the life of the balance.

The APR probably won’t be 0%, but it should be something below 5% APR, which may be cheaper than the 0% APR offer (assuming there aren’t any balance transfer fees) over the long term.

Alternatively, you can look into a second balance transfer around the time the first one ends, though the offers may run dry if you continually use them.

I am looking for an zero percent card