The cool thing about the credit card industry is the ability to negotiate. In truth, you can negotiate just about anything in life if you’re brave enough to speak your mind, but when if comes to credit cards, it’s always an option.

Often times, all you need to do is ask. Yep, just call your credit card issuer and ask for a discount, a deal, or a waived fee.

Even if they don’t agree to your plea (sorry I’m good at rhyming), there’s a good chance they’ll offer some kind of concession that will make the short phone call worth your while.

Waive That Balance Transfer Fee!

- One downside to balance transfers is the associated fee

- But it is possible to get this fee waived by the credit card issuer

- Simply pick up the phone and ask a customer service rep or send a secure message

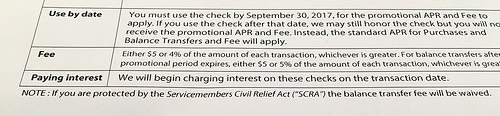

- Or if you’re active duty military, it’s also possible under the Servicemembers Civil Relief Act (SCRA)

For example, if you’re interested in a credit card balance transfer, but the hefty balance transfer fee is holding you back, call up the card issuer and ask them to waive the fee (or simply look for a no fee balance transfer).

Tell them you’re interested in transferring your balance, but you’d like the “balance transfer fee waived.”

Remember, customers are highly lucrative to credit card issuers, so they’ll want to appease you in any way they can, assuming you’re attractive to them (financially).

Tip: If you have a bad credit score, this probably isn’t going to work. You need to be a creditworthy customer that fits the mold for what they’re looking for.

[What credit score do you need for a balance transfer?]

Sure, they might not agree to completely waive the balance transfer fee, but they may offer to cut the fee in half.

So if the standard balance transfer fee is 3%, maybe they’ll drop it down to 2% or 1%. Or if there is no maximum fee, perhaps they’ll throw a limit on it to snag your business.

All you have to do is state your case and hope for the best. It doesn’t hurt to ask! As always, the squeaky wheel gets the grease…

If you happen to be an active duty servicemember and/or are protected by the Servicemembers Civil Relief Act (“SCRA”), it’s possible to get the balance transfer fee waived.

Just let the issuer know. This might even work if you served in the past. Be sure to mention it to the customer service rep while making your request.

All You Have to Do Is Ask for It to Be Waived!

- Formulate a plan/argument before you call the credit card issuer

- Mention another credit card that doesn’t charge a balance transfer fee

- If it doesn’t work, you can HUCA (hang up and call again)

- Or simply look for a no fee balance transfer offer instead

You don’t have to be an expert to negotiate your balance transfer fee, just take a moment to gather some facts about your situation so you can explain why it would benefit the credit card issuer.

If you’ve got lots of credit card debt, but always manage to pay on time, it may be in their interest (no pun intended) to waive the balance transfer fee.

After all, they want to keep/acquire you as a customer, so they’ll be willing to meet you halfway if you present your argument in a concise and compelling manner.

Don’t just call up without a plan, or they could shoot you down within seconds.

As a rule of thumb, it’s always good to bring up offers you’ve seen elsewhere, since most credit card issuers will match other existing deals, especially if they come from their competitors.

If you call Discover, mention the fact that Chase offers a no fee balance transfer (assuming the latter offer doesn’t work for you).

Just watch out for bad offers, such as giving you points, cash back, or miles if you spend X amount in purchases.

Generally, you don’t want to combine new purchases and transferred balances on the same credit card.

After all, you’re trying to get out of debt here, not add more on. So make sure any offer or bonus they throw your way doesn’t just set you up for more heartache.

Tip: Even if you don’t transfer a balance, ask for a better interest rate on your existing credit card if you feel you’re being charged too much.

Every little bit helps. And a simple phone call could lead to a lower interest rate, which could save you hundreds to thousands of dollars.

I’ve tried this before and always get shot down. But I guess it’s worth a minute to ask…

I’ve tried and tried but they never agree to waive the fee. I even do the HUCA and every CSR says NO.

HUCA = Hang Up, Call Again can be effective, but sometimes the CSRs have no power to waive the fee. You might want to explore the no fee options if they won’t waive.

I’ve tried multiple times and never am able to get the fee waived…