Balance Transfer Fees Are Attached to Most Offers

- Most balance transfer offers come with a small fee

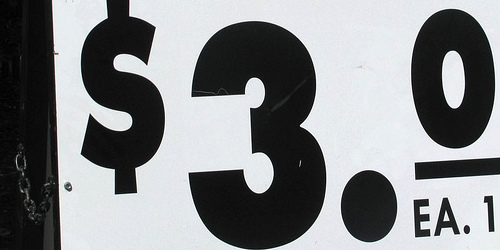

- Typically it’s 3% of the transfer amount with a dollar amount minimum

- So if you transfer $2,500, the fee might be $75

- This makes your total outstanding balance $2,575

A balance transfer credit card can be quite handy if you’ve got a lot of existing credit card debt that’s subject to costly finance charges, but the main drawback is the associated “balance transfer fee.”

Yep, there’s often a cost to transferring a balance because credit card companies aren’t in the business of just helping you out for free.

In exchange for that awesome 0% intro APR, balance transfer credit cards typically come with an upfront 3% fee, though it can be as high as 5%. So for every $1,000 you transfer, you’ll likely pay $30 to $50.

It’s basically the credit card issuers way of ensuring they make some money while taking on your debt since they won’t be making any interest income if the APR is set at zero.

Most balance transfers have fees, but there are plenty of big banks and credit unions that waive the fee or don’t charge it all.

What Is a Balance Transfer Fee?

- Think of the one-time fee as prepaid interest

- If the bank is giving you a 0% loan, they often want something upfront

- But not credit card issuers charge a fee for balance transfers

- Look for a no-fee balance transfer that also offers 0% APR to snag the best deal

It’s essentially prepaid interest in exchange for 0% intro APR.

As mentioned, these fees can range from 3-5% of the amount transferred, and typically have a minimum of say $10.

The average balance transfer fee is 3%. If you’re being charged more, know that you can probably do better.

They charge these fees to ensure they make money off cardholders who are taking advantage of their 0% APR and other low-rate offers.

If they didn’t charge fees, they would essentially run the risk of a cardholder moving their credit card debt to them, making only the minimum payment each month, and then transferring it again before the promotional 0% APR ended.

In other words, the credit card companies wouldn’t make a dime!

Balance transfer fee example:

Amount transferred: $2,500

Balance transfer fee: 3%

Balance transfer cost: $75

New balance: $2,575

In this rather common scenario, you’d have to pay $75 for the privilege of transferring your credit card balance to another credit card issuer.

In exchange for that fee, the new credit card company would agree to take on your credit card balance at a lower interest rate.

This one-time fee is added to your new balance, so in our example you would owe $2,575 on your new credit card right off the bat.

While higher than your old balance, it won’t accrue any new interest if set at 0% APR, which means each and every dollar paid during the promotional period will pay down the outstanding balance. That’s where you win.

However, if the APR is above 0%, you will pay interest on the balance transfer fee.

Generally, there is a minimum amount you must pay to transfer a balance, such as $5 or $10, assuming it’s not a no fee balance transfer offer.

In the past, it was fairly easy to get your hands on a no fee balance transfer, but the financial collapse that occurred in late 2006 wiped out many of those deals.

No Balance Transfer Fees Used to Be the Norm

During the boom years, many savvy consumers took advantage of no fee balance transfer offers, and moved credit card debt from one card to the next, all the while never paying a dime in interest, or any fees.

But credit card issuers quickly (well, not that quickly) caught wind of this so-called “balance transfer arbitrage,” and started slapping fees onto their balance transfer offers.

Not only did they add fees, but in many cases, they raised fees from 3% to 5% and removed maximum fees on balance transfers.

Before the credit crunch, most fees were capped at a certain dollar amount, such as $75, regardless of how large the transfer amount was. Clearly this was a huge benefit for those transferring big balances.

Today, it’s not uncommon to see a balance transfer offer with no cap on the fee, meaning you could pay a hefty amount on a large balance.

In short, it may cost money to do a balance transfer today, though the savings can easily eclipse any upfront costs.

Typical BT Fees Charged by Credit Card Company

| Card Issuer | Balance Transfer Fee |

| American Express | 3%, $5 minimum |

| Bank of America | 3%, $10 minimum |

| Barclaycard | 3%, $5 min. |

| Capital One | 3%, doesn’t mention a minimum |

| Chase | Higher of 3% or $5 |

| Citi | 3%/$5 min. |

| Discover | 3%, no minimum fee mentioned |

| HSBC | 4%, at least $10 |

| Santander Bank | 4% or $10, whichever is higher |

| U.S. Bank | 3%, $5 floor |

| Wells Fargo | 3%, $5 min. |

*Note that these fees may vary based on the credit card in question. And there are some cards that don’t charge bt fees, such as Chase Slate. So always check the fine print!

No Maximum Fee on Balance Transfers

Nowadays, a lot of credit card issuers have removed balance transfer fee caps, so there is no maximum fee they can charge.

This is certainly something to pay attention to, given the fact that balance transfer fees can be sky-high on large credit card balances.

At the same time, credit card issuers have increased balance transfer fees from 3% to 5% on many credit card balance transfer offers, so the costs have essentially risen two-fold and can be quite substantial.

What no maximum fee on a balance transfer can cost you:

Current credit card debt: $7,500 @ 19.99% APR

Balance transfer offer: 0% APR for 12 months, 12.99% APR thereafter

Balance transfer fee: 5%, no maximum

Balance transfer limit: $10,000

In this scenario, you’d be stuck paying $375 in balance transfer fees to move $7,500 to the 0% APR balance transfer credit card. Yikes. That doesn’t sound like a deal, does it?

Of course, it’s cheaper than keeping the balance with your existing credit card issuer and paying $1,500 in credit card finance charges annually (simple mathematics).

But it’s still very expensive, and the last thing you want to do is take on more debt at the very moment you’re trying to pay it down.

So if you have a sky-high balance, you may want to just call your credit card issuer and ask that they reduce the interest rate on your credit card instead.

Just tell them you’re thinking about transferring the balance elsewhere, but want to see if they want to make a deal first.

After that, you may want to consider moving just a portion of the balance if the interest rate is still relatively high.

There Used to Be Balance Transfer Fee Caps

Not so long ago, the cost could have been significantly lower, as the balance transfer fee would have probably been set at 3% with a $150 maximum.

So instead of paying $375 in balance transfer fees, you’d only have to pay $150 since it couldn’t go beyond the max, regardless of how large your credit card balance was.

So cardholders with sizable balances have basically been hit twice. First, with higher balance transfer fees, and second, with no maximums on those fees.

If you’ve got a large credit card balance you’d like to transfer, look for balance transfer fees that are maxed at a certain dollar amount.

Or better yet, keep an eye out for a no fee balance transfer credit card. There always tends to be one out there.

Just realize that a no fee balance transfer probably won’t offer 0% APR, but rather a low fixed rate for the life of the balance, which while seemingly unfavorable, could end up being cheaper than the alternative.

You Can Still Avoid Balance Transfer Fees!

However, there are still no fee balance transfer offers out there if you look hard enough, and even with the fees, balance transfers can save you some serious money.

The key is to determine whether a balance transfer makes sense for you (fee and all) by looking at your current interest rate and the balance transfer interest rate, factoring in any fees.

Even with a 5% fee, it could be the right move, especially if your current credit card has a sky-high APR.

Most credit cards carry APR in the teens or higher, so moving a credit card balance to a credit card with an APR of 0% or something in the single digits could be a huge money saver.

Tip: If you can’t find a no fee balance transfer, why not simply ask your credit card issuer to waive the balance transfer fee.